Our Work

Explore our renovation and construction projects

Tap image → project

Home

Kitchen

Living Room

Bathroom

Roof Repair

Exterior Pavement

Digging, Plumbing & Repair

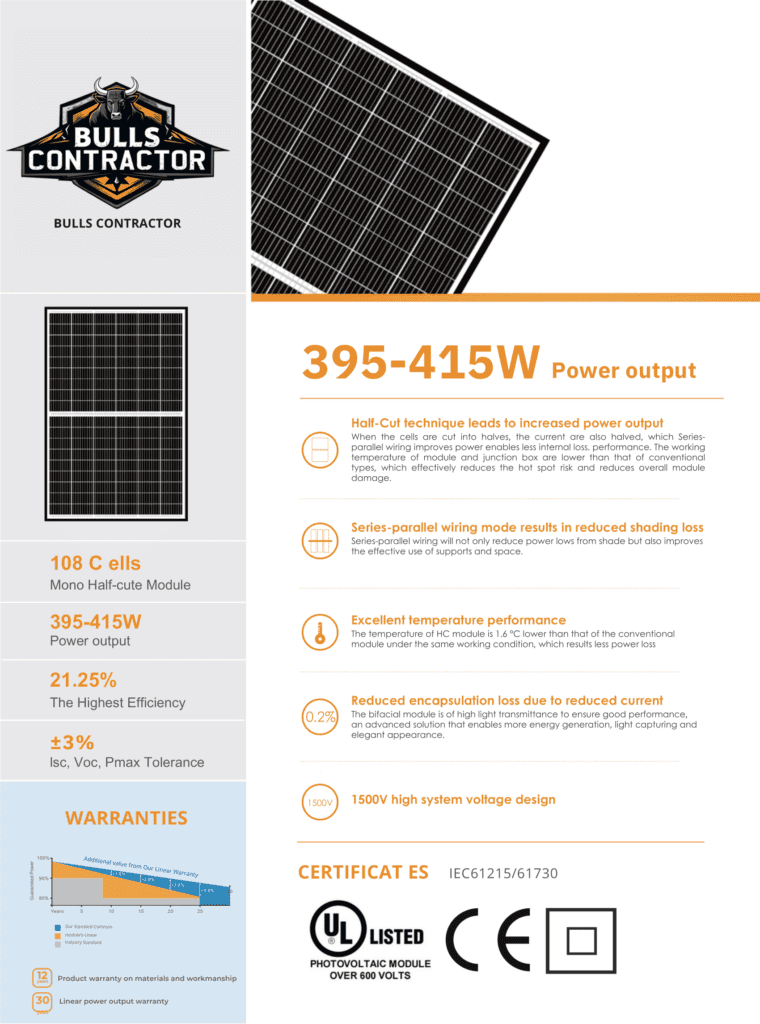

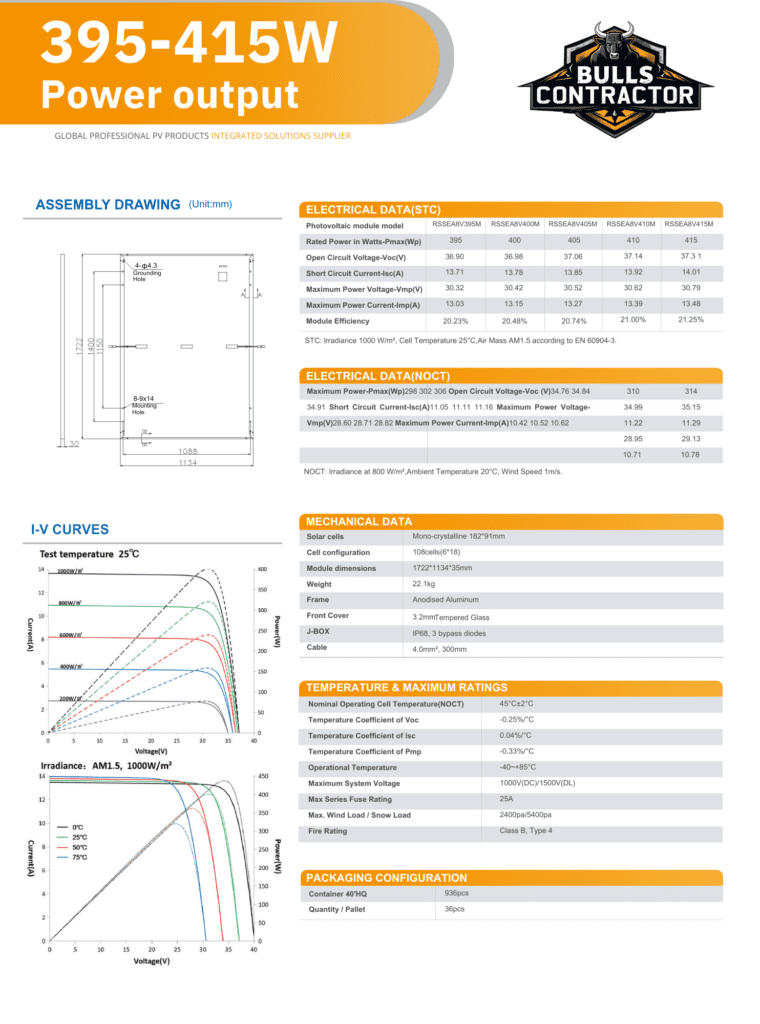

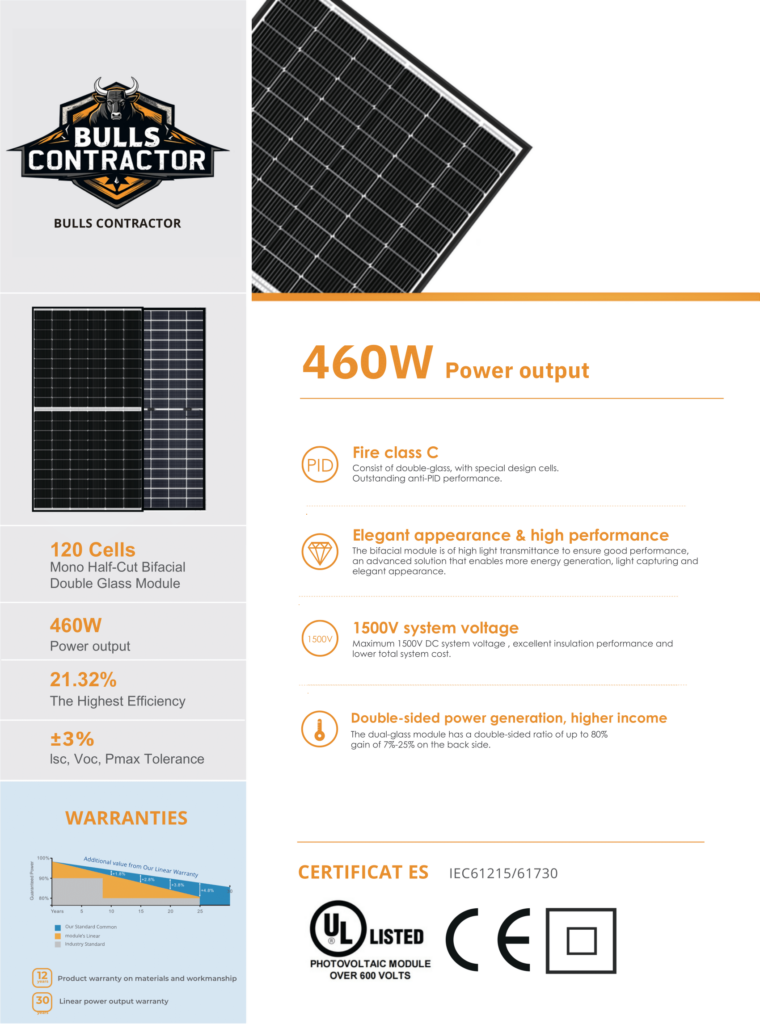

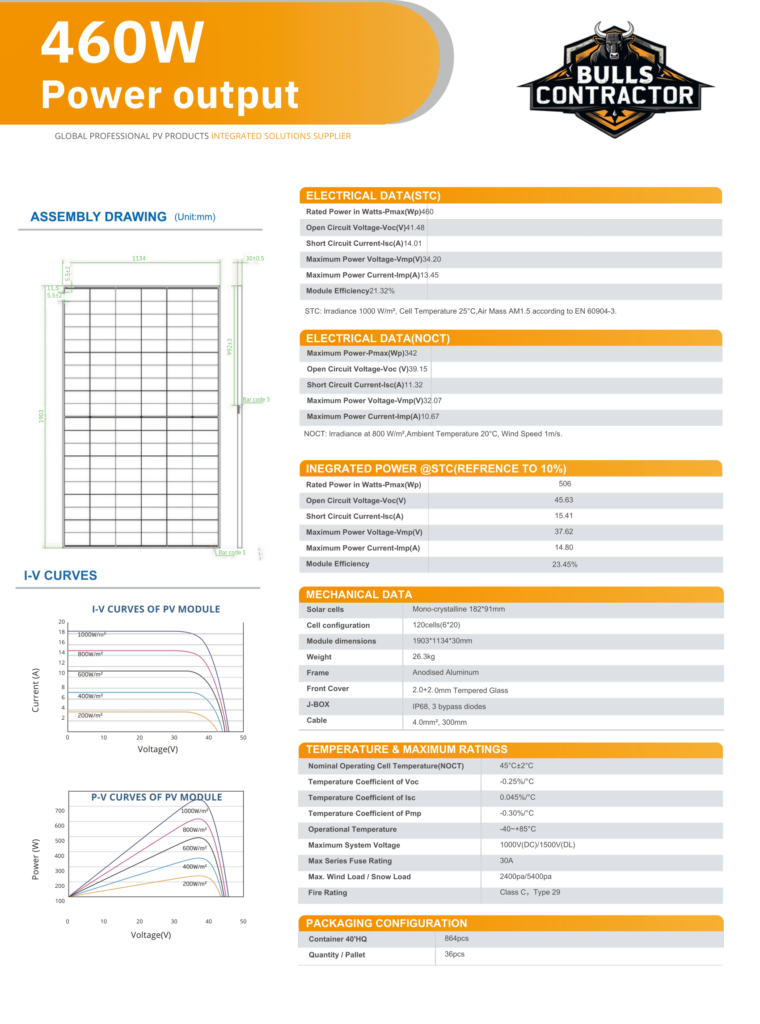

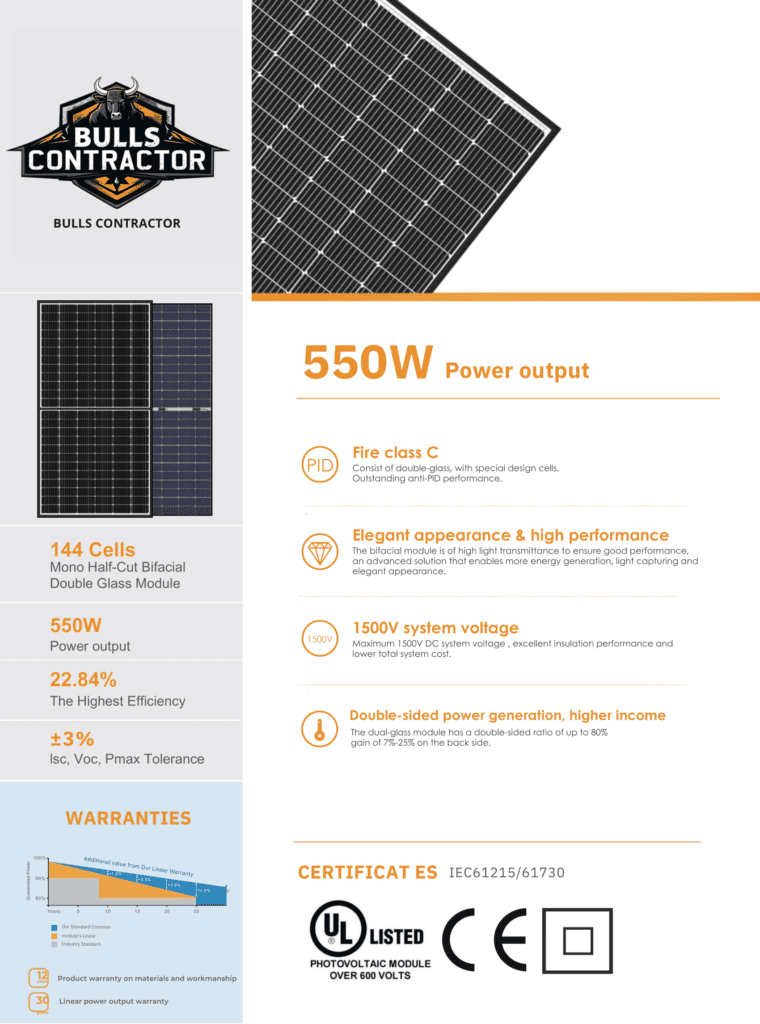

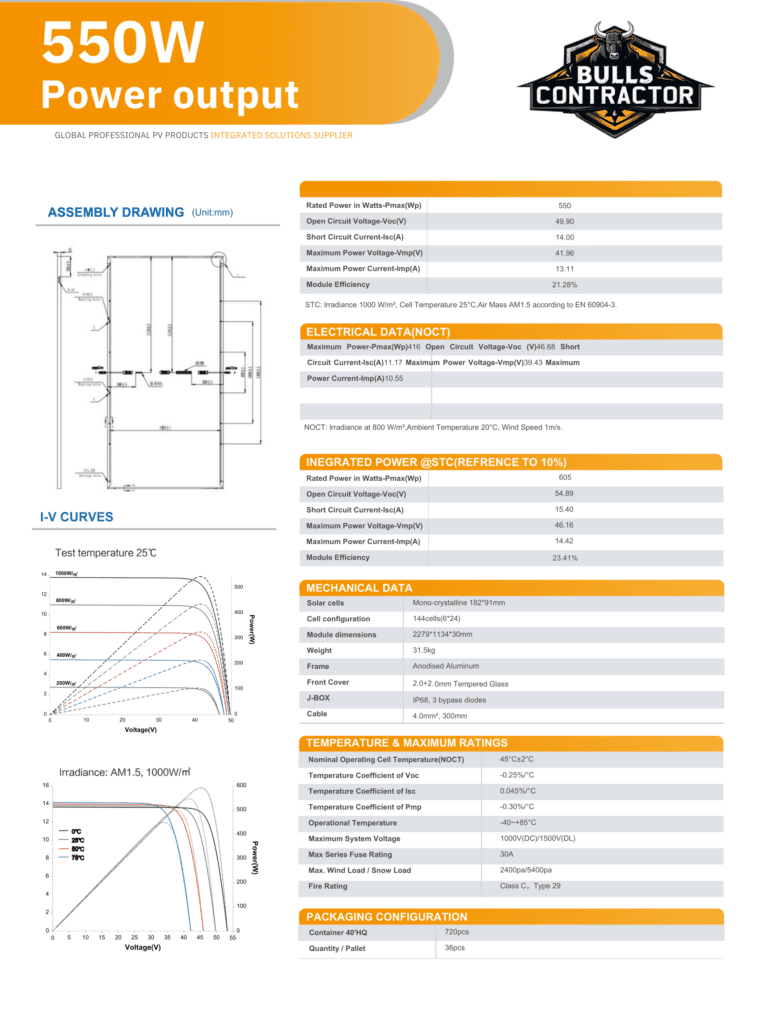

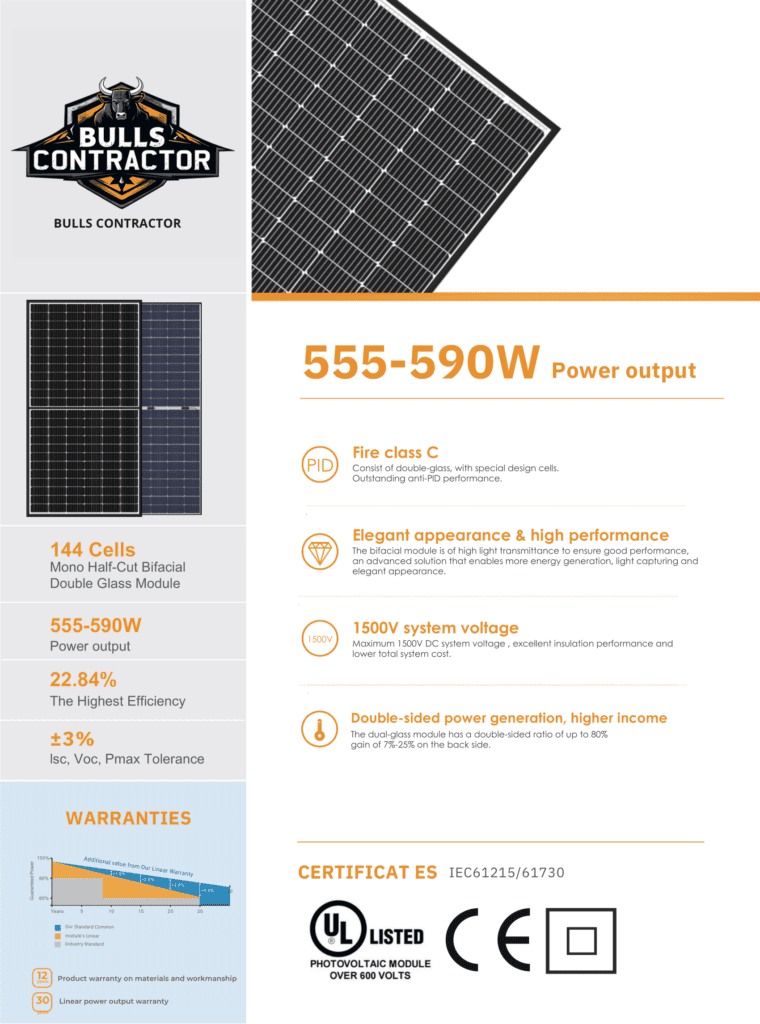

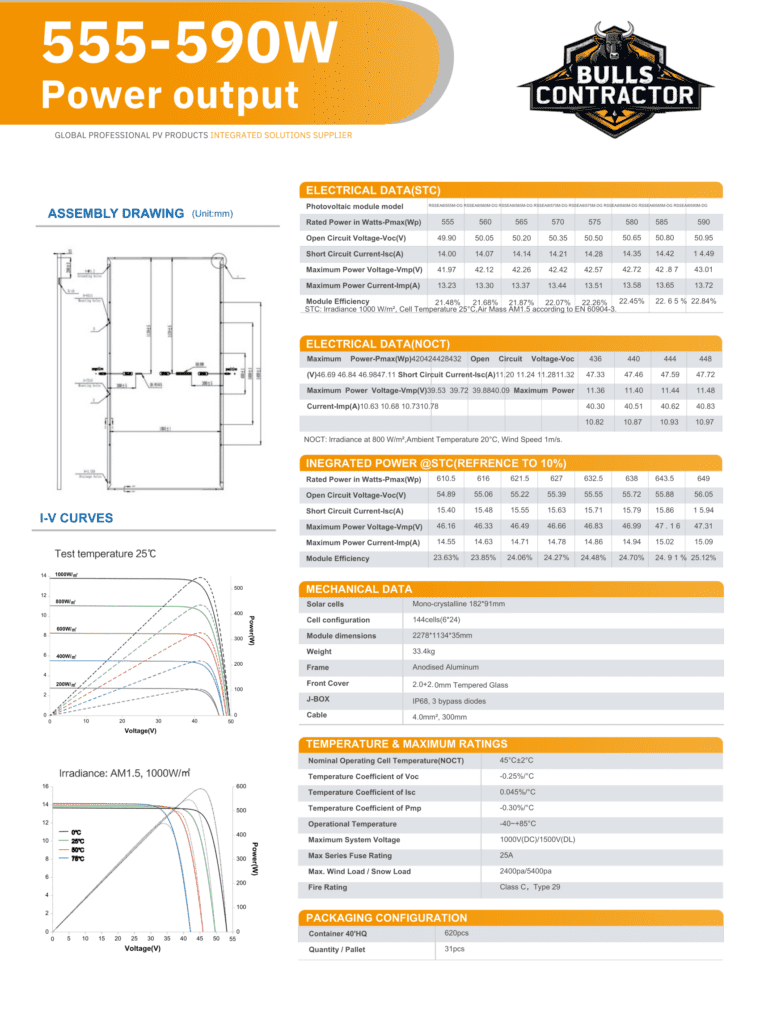

Solar Panels

This will close in 0 seconds

This will close in 0 seconds

This will close in 0 seconds

This will close in 0 seconds

Disclaimer: This information is provided as a general guide. Tax policies can change, so please consult a tax professional or official government resources for personalized advice.

1. Federal Solar Tax Credit (Residential Clean Energy Credit)

2. State and Local Incentives

3. Consult a Tax Professional

4. Additional Tools & Quick Start

For any questions, please contact us:

This will close in 0 seconds

Selling extra energy generated by your solar panels back to the grid in the U.S. typically involves participating in a program like - net metering - or a similar solar buyback arrangement offered by your utility company. Here’s a step-by-step guide on how to do it:

1. Confirm Availability of Net Metering or Buyback Programs

2. Install a Grid-Tied Solar System

3. Sign Up for Net Metering or a Buyback Program

4. Generate and Send Excess Energy

5. Get Compensated

6. Monitor and Maintain

Key Tips

Quick Start

This process can save you $1,000–$2,000 annually on bills and earn modest extra income, depending on your setup and location.To find out if you qualify for tax incentives for buying solar panels for your home, you can use a combination of online resources, local contacts, and professional advice. Here’s where and how to check:

For any questions, please contact us:

This will close in 0 seconds